Of all the arguments that have been raised this turbulent spring in our country, one stands out as egregiously vulgar. It evokes in me the moral equivalent of the middle-ear reflex to high intensity sounds, which has a special place in the hierarchy of unpleasant sensations.

It's the tax nationalism argument. In essence, it's this: How dare students benefitting from subsidized education funded by OUR tax money hold opinions that run counter to ours. To mask the real hideousness of this question, clumsy caveats are added. We are talking about politicking and not politics (what is the difference?), student politics is fine but not anti-national slogans, and so on.

At the heart of this line of argument is the great Indian upper middle class angst that we pay the taxes and hence are entitled to greater share of hand-wringing over how our tax money is spent. It betrays a longing lurking just beneath the surface--for a world where votes weren't tax-agnostic, a country that is more like a corporation, where your share in equity capital determines your share of control.

Padmashri T. Mohandas Pai is a vocal proponent of this argument, but he is by no means alone in this thinking. That reliable indicator of popular sentiment among People Like Us--the memes that go viral on Facebook and Whatsapp--have for a while been harping over the shocking non-fact that only 3.2% of Indians pay taxes. The rest, like the worthless PhD scholars of JNU, pay no taxes, live off our taxes and have the temerity to oppose us in television debates.

It's an absurd argument that deserves a swift burial.

It's true that only 3.2% (or thereabouts) of India's population pays personal income tax. This is mostly because only that many people have incomes high enough to be taxed (Rs250,000, or $3,700 per annum).

But does this mean only 3.2% of Indians contribute to taxes? No!

Let us turn to the budget that has just been delivered. It estimates that in the 2016-17 financial year, government will receive Rs16 lakh crore in gross tax revenue. Of this, how much is the contribution of personal income tax? Rs3.5 lakh crore, or 21%.

![kanhaiya kumar]()

Kanhaiya Kumar and JNU students address the media.

Where does the rest of it come from?

Income tax and corporation tax (the latter is about Rs5 lakh crore or 31% of the total receipts) constitute that part of the tax kitty known as direct taxes. Then there are indirect taxes, which are customs, excise and service tax (together Rs7.7 lakh crore or 48%). These are taxes paid by every citizen, including the poor, when they consume anything--a pack of salt or soap or a matchbox, or services like electricity, telecom or transportation.

Even within direct taxes, the bigger chunk is corporation tax. This money is coming from corporate profits. Every consumer, irrespective of whether or not they pay personal income tax, contribute to corporate profits and consequently to this category of taxes.

In other words, 79% of the tax kitty is a contribution by the economic activity and all of its participants, not just those who pay personal income tax.

Are JNU research scholars the big beneficiaries of exchequer largesse? Hardly.

Even the poor are not the exclusive beneficiaries of subsidies. The Economic Survey this year has devoted an entire chapter to the matter of subsidies that go to the rich, titled Bounties For The Well Off. Analyzing just 9 subsidies--Kerosene, Electricity, LPG, Railways, Petrol, Diesel, Aviation Turbine Fuel, Gold and PPF--it found that share of subsidies going to the rich (defined as the top 70% of the consuming class) was Rs1.03 lakh crore. A good explanation of this phenomena can be found here.

So it's not just the personal income tax payers who contribute to taxes, and it's also not just the poor who benefit from. In fact the very people who whip out the tax argument benefit from such implicit and explicit subsidies.

Now let's look at the tax benefits enjoyed by corporations.

Out of a universe of 5.6 lakh companies in India, 2.5 lakh paid no taxes last year because they made no profits.

The average statutory tax rate for companies with income upto Rs10 crore is 32.45% and above that is 33.99%. But that is only on paper. The actual effective tax paid by companies during 2013-14 was just 23.22%. The largest companies, with taxable profit of more than Rs500 crore (there were 263 such companies), paid tax at an effective rate of 20.68%. Why? Because companies benefit from a number of exemptions and loopholes that have accumulated in the tax code over the years.

All of these exemptions together amounted to Rs98,407 crore in 2014-15, according to budget estimates.

One industry that has most benefitted from tax exemptions in recent years is the information technology (IT) and IT-enabled services (ITES) industries. In 1999, the government granted the industry a 10-year tax holiday under a scheme called the Software Technology Parks of India (STPI). This had the desired effect of providing a massive impetus to the industry and in less than 10 years many companies became giants, generating thousands of crores in profits, and the industry became a key engine of growth and employment.

The well-regarded Infosys founder N.R. Naryana Murthy reflected the thoughts of many when he said that the 10-year tax holiday needn't be continued. This is what he said in 2010: "Asking for tax exemption for tens of years in my opinion is not the smartest thing. When we criticize subsidy to farmers, to poor people and NREGA (Mahatma Gandhi National Rural Employment Guarantee Act) schemes, what is the justification in rich industrialists making thousands of crores of profits asking for continuing their tax exemptions. Frankly, I find it is somewhat vulgar."

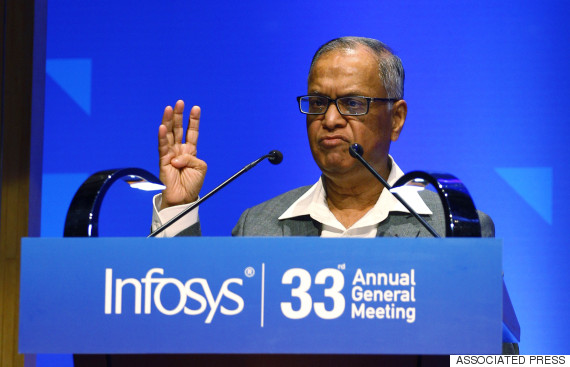

![narayana murthy]()

Narayana Murthy.

But Murthy was the rare voice from the industry that thought this way. Most senior executives and the industry lobby NASSCOM was busy pushing for an extension of the tax holiday. A key spokesperson was T. Mohandas Pai, then a board member of Infosys and its HR director. Ahead of the budget in 2008, Pai warned that India would "lose out"--a polite way of saying his company would take the business elsewhere--if the government did not extend the tax holiday. "If all of us start looking at (greener) pastures outside like creating jobs in place like (the) Philippines, China, Eastern Europe, Mexico and some other countries, there will be challenges (in India)", Pai said.

The government did not extend the tax holiday, but it allowed the industry to continue optimizing taxes by setting up special economic zones. Every IT major set up such SEZs or set up shops in such SEZs and continue to derive tax exemptions.

By Mr Pai's calculations, in 2006, the tax holiday to the IT industry was worth Rs125,000 crore.

There is of course nothing wrong with tax holidays or companies seeking benefits in line with government policy. But when those who lobbied aggressively for such benefits turn on student fellowships and say they should shut up because they benefit from a subsidized education, the hypocrisy is staggering.

You can wish ill of your political rivals but you (mercifully) can't exclude them from subsidies. And to say that those benefitting from subsidies must behave in a certain way (study, not get involved in politics) is revealing of a feudal mindset. Subsidy recipients are not lesser citizens. This nation does not impose behavioural conditionalities on them and that is how it must remain.

It's the tax nationalism argument. In essence, it's this: How dare students benefitting from subsidized education funded by OUR tax money hold opinions that run counter to ours. To mask the real hideousness of this question, clumsy caveats are added. We are talking about politicking and not politics (what is the difference?), student politics is fine but not anti-national slogans, and so on.

At the heart of this line of argument is the great Indian upper middle class angst that we pay the taxes and hence are entitled to greater share of hand-wringing over how our tax money is spent. It betrays a longing lurking just beneath the surface--for a world where votes weren't tax-agnostic, a country that is more like a corporation, where your share in equity capital determines your share of control.

We need freedom from people like Kanhaiya who are sponging off our taxes,politicking at our cost,depriving others RT https://t.co/ib7PdE28WT

-- Mohandas Pai (@TVMohandasPai) March 4, 2016

Padmashri T. Mohandas Pai is a vocal proponent of this argument, but he is by no means alone in this thinking. That reliable indicator of popular sentiment among People Like Us--the memes that go viral on Facebook and Whatsapp--have for a while been harping over the shocking non-fact that only 3.2% of Indians pay taxes. The rest, like the worthless PhD scholars of JNU, pay no taxes, live off our taxes and have the temerity to oppose us in television debates.

It's an absurd argument that deserves a swift burial.

It's true that only 3.2% (or thereabouts) of India's population pays personal income tax. This is mostly because only that many people have incomes high enough to be taxed (Rs250,000, or $3,700 per annum).

But does this mean only 3.2% of Indians contribute to taxes? No!

Let us turn to the budget that has just been delivered. It estimates that in the 2016-17 financial year, government will receive Rs16 lakh crore in gross tax revenue. Of this, how much is the contribution of personal income tax? Rs3.5 lakh crore, or 21%.

Kanhaiya Kumar and JNU students address the media.

Where does the rest of it come from?

Income tax and corporation tax (the latter is about Rs5 lakh crore or 31% of the total receipts) constitute that part of the tax kitty known as direct taxes. Then there are indirect taxes, which are customs, excise and service tax (together Rs7.7 lakh crore or 48%). These are taxes paid by every citizen, including the poor, when they consume anything--a pack of salt or soap or a matchbox, or services like electricity, telecom or transportation.

Even within direct taxes, the bigger chunk is corporation tax. This money is coming from corporate profits. Every consumer, irrespective of whether or not they pay personal income tax, contribute to corporate profits and consequently to this category of taxes.

In other words, 79% of the tax kitty is a contribution by the economic activity and all of its participants, not just those who pay personal income tax.

Are JNU research scholars the big beneficiaries of exchequer largesse? Hardly.

Even the poor are not the exclusive beneficiaries of subsidies. The Economic Survey this year has devoted an entire chapter to the matter of subsidies that go to the rich, titled Bounties For The Well Off. Analyzing just 9 subsidies--Kerosene, Electricity, LPG, Railways, Petrol, Diesel, Aviation Turbine Fuel, Gold and PPF--it found that share of subsidies going to the rich (defined as the top 70% of the consuming class) was Rs1.03 lakh crore. A good explanation of this phenomena can be found here.

So it's not just the personal income tax payers who contribute to taxes, and it's also not just the poor who benefit from. In fact the very people who whip out the tax argument benefit from such implicit and explicit subsidies.

Corporate exemptions

Now let's look at the tax benefits enjoyed by corporations.

Out of a universe of 5.6 lakh companies in India, 2.5 lakh paid no taxes last year because they made no profits.

The average statutory tax rate for companies with income upto Rs10 crore is 32.45% and above that is 33.99%. But that is only on paper. The actual effective tax paid by companies during 2013-14 was just 23.22%. The largest companies, with taxable profit of more than Rs500 crore (there were 263 such companies), paid tax at an effective rate of 20.68%. Why? Because companies benefit from a number of exemptions and loopholes that have accumulated in the tax code over the years.

All of these exemptions together amounted to Rs98,407 crore in 2014-15.

All of these exemptions together amounted to Rs98,407 crore in 2014-15, according to budget estimates.

One industry that has most benefitted from tax exemptions in recent years is the information technology (IT) and IT-enabled services (ITES) industries. In 1999, the government granted the industry a 10-year tax holiday under a scheme called the Software Technology Parks of India (STPI). This had the desired effect of providing a massive impetus to the industry and in less than 10 years many companies became giants, generating thousands of crores in profits, and the industry became a key engine of growth and employment.

The well-regarded Infosys founder N.R. Naryana Murthy reflected the thoughts of many when he said that the 10-year tax holiday needn't be continued. This is what he said in 2010: "Asking for tax exemption for tens of years in my opinion is not the smartest thing. When we criticize subsidy to farmers, to poor people and NREGA (Mahatma Gandhi National Rural Employment Guarantee Act) schemes, what is the justification in rich industrialists making thousands of crores of profits asking for continuing their tax exemptions. Frankly, I find it is somewhat vulgar."

Narayana Murthy.

But Murthy was the rare voice from the industry that thought this way. Most senior executives and the industry lobby NASSCOM was busy pushing for an extension of the tax holiday. A key spokesperson was T. Mohandas Pai, then a board member of Infosys and its HR director. Ahead of the budget in 2008, Pai warned that India would "lose out"--a polite way of saying his company would take the business elsewhere--if the government did not extend the tax holiday. "If all of us start looking at (greener) pastures outside like creating jobs in place like (the) Philippines, China, Eastern Europe, Mexico and some other countries, there will be challenges (in India)", Pai said.

The government did not extend the tax holiday, but it allowed the industry to continue optimizing taxes by setting up special economic zones. Every IT major set up such SEZs or set up shops in such SEZs and continue to derive tax exemptions.

By Mr Pai's calculations, in 2006, the tax holiday to the IT industry was worth Rs125,000 crore.

When those who lobbied aggressively for tax benefits turn on student fellowships and say they should shut up because they benefit from a subsidized education, the hypocrisy is staggering.

There is of course nothing wrong with tax holidays or companies seeking benefits in line with government policy. But when those who lobbied aggressively for such benefits turn on student fellowships and say they should shut up because they benefit from a subsidized education, the hypocrisy is staggering.

You can wish ill of your political rivals but you (mercifully) can't exclude them from subsidies. And to say that those benefitting from subsidies must behave in a certain way (study, not get involved in politics) is revealing of a feudal mindset. Subsidy recipients are not lesser citizens. This nation does not impose behavioural conditionalities on them and that is how it must remain.